Balancing Act: A Guide to Responsible Credit Card Use and Debt Management Plan

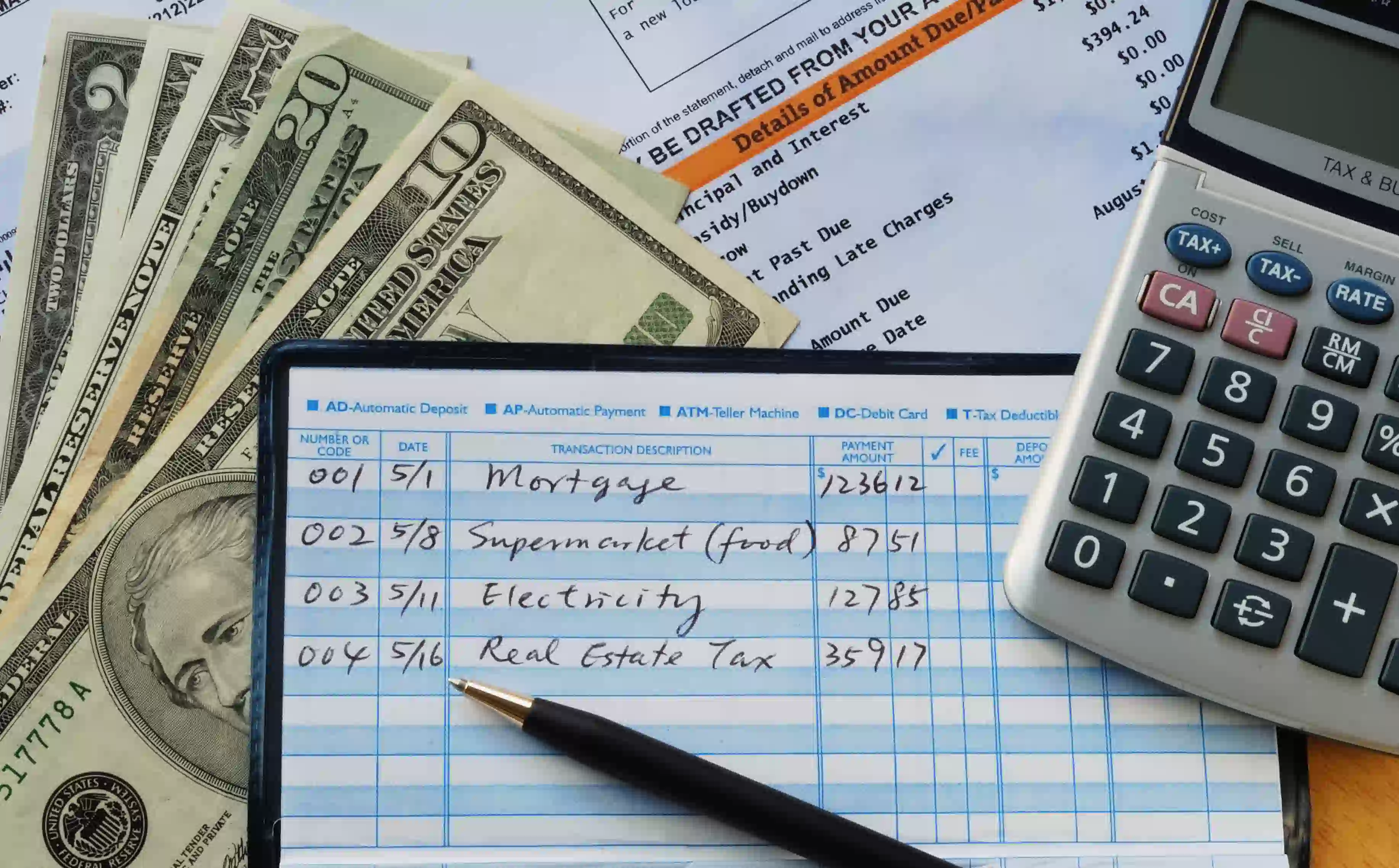

Credit card debt is a widespread concern affecting many people in today's financial landscape. Many individuals find themselves grappling with the challenges posed by credit card balances and the ease of swiping plastic for purchases. It's essential to recognize when this convenience turns into a financial issue. Understanding when this kind of debt becomes problematic is key to avoiding potential pitfalls that could lead to financial stress. Striking a balance between using it responsibly and avoiding excessive credit card-related debt is crucial for maintaining financial well-being.

In this article, we'll take a closer look at the prevalence of credit card debt, emphasize the importance of recognizing warning signs, and provide practical tips on navigating the fine line between responsible credit counseling use and potential financial troubles.

The Impact of Credit Card Debt

When credit card debt becomes excessive, the immediate consequence is often a decline in credit scores, impacting one's ability to secure favorable loan terms or make monthly credit card payments again in the future. This, in turn, can create a ripple effect on overall financial well-being, leading to increased stress and limited financial flexibility. To provide a more relatable perspective, real-life examples are shared, showcasing the negative outcomes of unmanageable credit card debt.

Here are three examples illustrating the negative impact of irresponsible debt management:

- Emily's Stress and Anxiety: Emily, a small business owner, used credit cards to fund her startup. As the business faced challenges, so did her finances. Mounting credit card debt became a constant source of stress and anxiety, affecting both her personal and professional life. The weight of her financial situation hindered Emily's ability to focus on business growth.

- David's Struggle with Credit Card Company: David, a father of two, experienced a job loss that led to credit card reliance for everyday expenses. With his missing payments, collection calls became a daily occurrence. The stress of dealing with creditors impacted David's mental health, making it even more challenging to navigate the job market and regain financial stability.

- Cynthia's Impact on Retirement Savings: Cynthia, approaching retirement, used credit cards for lifestyle expenses, assuming she could catch up later. However, the high annual fees eroded her retirement savings. Facing the reality of insufficient funds for her golden years, Cynthia grappled with the harsh consequences of prioritizing short-term wants over long-term financial security.

Factors to Consider

When managing finances, keep it simple by focusing on key factors. Start with your income-to-debt ratio, a straightforward measure of how much you're dedicating to debt repayment. Analyzing your interest rate and rates is equally crucial, as even small rates can have a lasting impact on one's financial situation. Understanding that minimum payments play a role in debt accumulation is essential—consistent late payments may lead to prolonged debt and higher interest rates and charges. By considering these factors without getting bogged down in complexity, you can make informed decisions for a more secure financial situation.

Recognizing Warning Signs

Recognizing warning signs of mounting credit card debt is vital for maintaining financial well-being without resorting to complicated terms. Keep an eye out for indicators that your credit card debt may be becoming unsustainable, such as struggling to make minimum payments or relying on your credit card bills for everyday expenses. Behavioral and emotional cues, like increased stress or anxiety about finances, can also signal potential trouble with credit card balance. Regular financial check-ins and self-assessments play a crucial role in staying ahead of these warning signs.

Simple practices, like reviewing monthly statements, receiving credit report alerts, and tracking spending habits, empower individuals to proactively manage their financial health, ensuring a more stable and stress-free financial future.

Setting Responsible Limits

Setting responsible limits on credit card usage is a fundamental step toward financial well-being. It involves establishing a manageable, secured card or credit card amount limit that aligns with one's income, preventing the temptation to overspend. Utilizing credit cards wisely when paying for essential purchases is another key aspect, ensuring that the convenience of paying with plastic doesn't lead to unnecessary debt.

To further foster responsible use of a credit card, here are five tips for avoiding unnecessary and impulsive and comparing credit cards and report spending:

- Create a Budget: Develop a comprehensive budget that outlines your monthly expenses and allocates specific amounts for discretionary spending. Having a clear understanding of your financial limits will help curb impulsive purchases.

- Use Cash for Non-Essentials: Consider using cash rather than a debit card for discretionary spending. When you physically see and handle money, it creates a more tangible connection to your finances, making it easier to resist impulsive purchases.

- Implement a Waiting Period: Before making non-essential purchases, institute a waiting period, such as 24 hours or a week. This gives you time to assess whether the purchase is truly necessary or if it's a momentary impulse that can be avoided.

- Track Your Spending: Regularly monitor your credit card report to track spending patterns. This helps in identifying areas where you might be overspending and allows for timely adjustments to your budget and financial habits.

- Limit the Number of Credit Cards: Having multiple credit cards can increase the temptation to spend beyond your means. Consider reducing the number of credit cards you possess to minimize the risk of impulsive purchases and better manage your overall financial picture.

Strategies for Debt Reduction

Reducing debt is achievable with straightforward strategies and a debt management plan. Create a personalized payment plan with manageable monthly payments. Explore debt consolidation options with your credit card issuer, considering their pros and cons for simplicity. Seek professional financial advice from a credit counseling organization or credit counseling agencies for tailored solutions. Establish and stick to a household budget, allocating funds for debt repayment and essential expenses.

By implementing these practical steps and sticking to your debt management plan, the path to debt reduction becomes clearer and more attainable.

Building Healthy Credit Habits

Building healthy credit habits is essential, emphasizing timely payments and responsible credit use. Credit cards serve as valuable tools for establishing a positive credit history when used wisely. Long-term financial strategies are vital for a sustainable debt management plan, requiring thoughtful planning of debt management plans and budgeting.

However, an alternative perspective, as advocated by Dave Ramsey's "Financial Peace," suggests avoiding credit cards entirely. Ramsey encourages individuals to adopt a cash-based approach to personal finance, emphasizing the elimination of credit card usage altogether. He argues that relying on cash helps people develop a better understanding of their spending habits and promotes financial discipline.

Case Studies

Real-life success stories of individuals effectively managing and reducing credit card debt offer valuable insights into debt relief without resorting to complex language. These case studies provide practical lessons and key takeaways, highlighting the strategies that led to successful debt reduction.

- Jeff and Lucy came to Financial Peace University with over $30,000 in credit card debt. After choosing to cut up credit cards, learning about zero-based budgeting, and learning how to use and implement the snowball debt payoff method, they are currently paying off their debts and learning how to make different choices to make their future more financially stable. They want you to know that knowledge and discipline of practicing what you learn are the keys to future success.

- Kathy, a single Mom, was struggling with credit card debt, a mortgage payment that was hard to pay, overwhelming lawyer bills, and still paying off her student loans from many years back. She felt like she was in sinking sand and there was no way out. After learning the principles of Financial Peace University, she decided enough is enough and she did not want to live that way any longer! She got radical and sold her home, moved into a more affordable apartment, cut back where she could, and started paying off her debt with the money she was saving from her new way of life. She wants you to know that she was okay with making radical decisions like moving, no more eating out, not making unnecessary purchases, and selling items in her home she no longer used…because those decisions are helping her to become debt-free sooner rather than never.

Conclusion

In conclusion, responsible use of credit cards boils down to timely payments, mindful spending, and knowing your financial limits. Take a moment for self-reflection and assess your financial habits. For those seeking additional guidance for building credit, consider the proactive step of a credit counselor or seeking professional advice. Small, intentional changes can pave the way for a more secure and stable financial future.

Seeking mental support for financial challenges is easily achievable.

- To learn more about our mental assistance services tailored to those facing financial difficulties, visit our website.

- For additional information, you can contact us via email at MSliva@WhatIsGrace.org.

- To participate in a mental support group designed for individuals navigating financial struggles, simply complete the registration form available on our website.

For more information about Financial Peace University or if you need assistance from the Care Ministry, please contact Michelle Sliva at 281.646.1903 or MSliva@WhatIsGrace.org.